SWOT Analysis: Another Two Countries Want to Up Their Gold Intake

By Frank E. Holmes

Strengths

- The best performing metal this week was palladium, up 1.49 percent as UBS published a report outlining its positive view on the precious metal; hedge funds raised their net long position in the metal after touching an eight-week low. Gold traders and analysts were neutral on their outlook for gold as a stronger U.S. dollar offset potential haven appeal, according to the weekly Bloomberg survey. UBS’s Joni Teves wrote that gold demand in India is supported by more wedding dates this year. Imports to the world’s second largest consumer of gold were up 60 percent year-over-year in April and 15 percent higher than the long-term average. More physical gold buying could be on its way from hedge funds and ETF investors. Bloomberg reports that positioning by money managers turned net long late in April and has been growing ever since, while holdings in ETFs have risen since May 13.

- Gold buying this year has so far largely come from the world’s central banks. Turkey’s gold reserves rose $63 million from the previous week, according to the central bank’s weekly figures. Kazakhstan increased its gold holdings in March to 11.79 million ounces. Russia, who is one of the biggest gold buyers, saw its first quarter gold output rise 13 percent year-over-year to 58.12 tons.

- Another two countries that want to up their gold intake? Serbia and the Philippines. The Serbian President told its central bank governor that it wants to start buying gold as a safety measure and boost reserves by 10 tons this year. The Philippines passed a law exempting gold sales by small-scale miners to the central bank from excise and income taxes, reports Reuters.

Weaknesses

- The worst performing metal this week was platinum, down 1.64 percent. Platinum fell to a three-month low this week as declining auto sales deter investors, reports Bloomberg. Audi signaled it plans to offer more than 30 electrified cars by 2035, replacing diesel vehicles. Sentiment for the metal reversed sharply this year as holdings in ETFs backed by platinum have slipped and the net-long position has fallen.

- Gold investors are getting tired of the lack of momentum in the metal’s trading. Ole Hansen, head of commodity strategy at Saxo Bank, told Bloomberg that “potential gold investors are being left frustrated and sidelined by the yellow metal’s lack of momentum despite an escalating trade war, heightened concern about stability in the Middle East, recent stock market gyrations and the decline of bond yields.”

- Zimbabwe, facing hyperinflation and shortages of foreign currency, fuel, medicine and more, has secured a $500 million loan by pledging an undeveloped mine to creditors. Bloomberg writes that the loan will be paid over four years when production of the mine starts and is backed by a mine that Great Dyke Investments owns – a venture between Russian investors and the Zimbabwean military.

Opportunities

- According to JPMorgan, traditional hedges like gold and the yen have not done well since the beginning of the U.S.-China trade war, but that could soon reverse due to a more dovish monetary backdrop. Bloomberg reports that strategists including John Normand wrote in a note last week that the combination of a Federal Reserve that has stopped tightening policy and investor positioning that suggests the two assets are under-owned and could see their performance as hedges improve in the rest of 2019 and 2020.

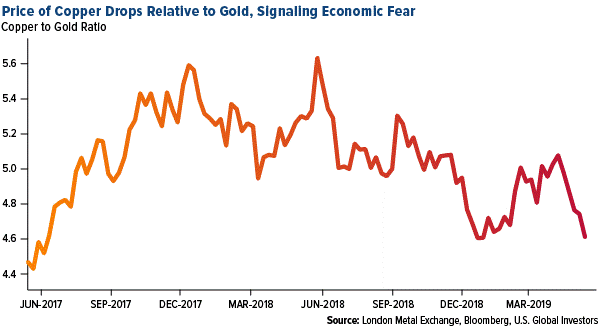

- On Wednesday gold futures rebounded from a two-week low as equities fell and copper continued to fall. What does the falling price of copper relative to gold have to do with anything? Bloomberg’s Eddie van der Walt writes that the ratio is a useful gauge of sentiment because it measures the price of a key industrial input (copper) against that of a perceived haven against economic turmoil (gold). The ratio is heading for a fifth straight weekly drop, which is the longest run since early 2018.

- Citi upgraded Newmont Goldcorp to a buy and said that it offers “superior value” versus its peers in a challenging market, reports Bloomberg. The bank also downgraded Barrick to neutral. Giant Barrick Gold Corp. is proposing it buys the shares of Acacia Mining Plc that it doesn’t already own at a discount. The proposal implies a valuation of $787 for the entirety of Acacia, which is well below current market capitalization of $832 million. Barrick’s last no premium offer for Newmont back in February was withdrawn after just 17 days, as investors thumbed their nose at the offer. Will a discounted offer win the day? Not likely.

Threats

- Diamond sellers continue to struggle. De Beer’s diamond sales plunged to the lowest since 2017 and dropped 25 percent from a year earlier. Bloomberg’s Thomas Biesheuval reports that diamond miners are facing challenges across the board and especially those producing cheaper and smaller gems where there is too much supply. A weaker rupee has made diamonds more expensive for Indian manufacturers who cut or polish nearly 90 percent of the global supply.

- Are Indians falling out of love with gold? The answer is potentially yes, according to younger consumers. About one third of Indians are aged 18 to 35 and they often prefer to spend their money on electronic gadgets with monthly installments rather than jewelry. Some say that gold is no longer a sign of wealth, but rather it is simply fashion. Another factor that could hurt gold buying is that mutual funds have returned 12.5 percent annually in the last decade, reports the Economist, and that during the same period gold prices increased by just 7 percent.

- This week we had an unsolicited call from a U.S.-listed company making a pitch on the merits of investing in their gold mining operation. We listened; you never know what is being presented until you hear the pitch. Unfortunately, these early stage investments are risky and one has to be a bit cautious. After all, you are handing your hard earned money over to someone in exchange for a piece of paper attached to a vision of future wealth creation. Often times retail investors might not know the right questions to ask in order to make an informed decision. This company is just starting to produce gold, thus they should have a resource statement (so there is reasonable disclosure of what assets the company is going to mine). There wasn’t one. The good news about the point we are making here, is that we have seen a lot of these promotions, but they don’t tend to surface as often, unless we are in a bull market for gold.