Quarterly Activities Report For the period ended 30 September 2020

HIGHLIGHTS:

Co-O Mine Operations

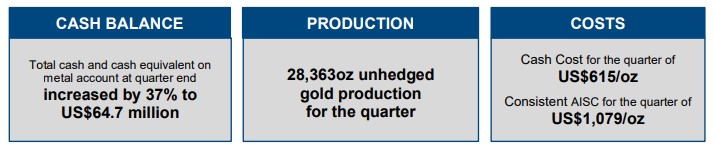

- Production: 28,363 ounces at average head grade of 7.56 g/t gold (June 2020 Qtr: 21,947 ounces at 6.59 g/t gold).

- Cash Costs: US$615 per ounce (Jun 2020 Qtr: US$692 per ounce).

- All-In-Sustaining-Costs (“AISC”): US$1,079 per ounce (Jun 2020 Qtr: US$1,116 per ounce).

- Mill performance: Gold recovery averaged 95.9% (Jun 2020 Qtr: 95.8%).

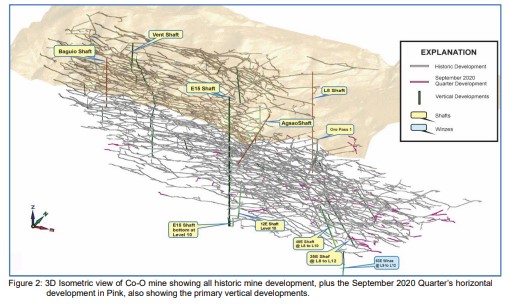

- Mine development: Total advance of 8,887 metres of horizontal and vertical development (Jun 2020 Qtr: 8,087 metres).

- COVID-19: Preventive measures to reduce the health risk to personnel while at work continue to be followed. A general community quarantine directive remains in place at end of quarter.

Co-O Mine Exploration

- Underground resource drilling

Total drilling for the quarter was 10,986 metres, a 78% increase from last quarter (Jun 2020 Qtr: 6,187 metres). Key areas and highlights are as follows:

- Reserve drilling at Levels 4,9 & 10 totalled 5,762 metres from 26 holes;

- Resource drilling at Level 10 totalled 5,224 metres from 10 holes; and

- High-grade results returned from the drilling included 2.3 metres @ 24.8g/t gold; 1.2 metres @ 70.3 g/t gold; 1.0 metres @ 101.6 g/t gold; 1.0metres @ 83.7 g/t gold; and 0.5 metres @ 143.0 g/t gold.

Regional and Near Mine Exploration

- Co-O near mine exploration:

- The easing of the COVID-19 work/travel restrictions enabled drilling at the Royal Crown Vein Gold Project to resume and completing three drillholes totalling 1,074 metres for this quarter; and

- Significant intercept is a zone of 67.15 metres (299.85 metres – 367.00 metres) @ 5.71 g/t gold, including 30.30 metres @ 5.89 g/t gold; and 22.35 metres @ 8.10 g/t gold.

Corporate and Financial

- Total cash and cash equivalent on metal account at quarter end increased by approximately 37% to US$64.7 million (Jun 2020 Qtr: US$47.1 million) after creditors, tax, interest charges and working capital movements.

- AGM scheduled for 29 October 2020. Raul Villanueva, current Executive Director, advises that he will not be standing for re-election to the Board.

- Patrick Warr appointed as CFO following the retirement of Peter Alphonso, who remains as Company Secretary.

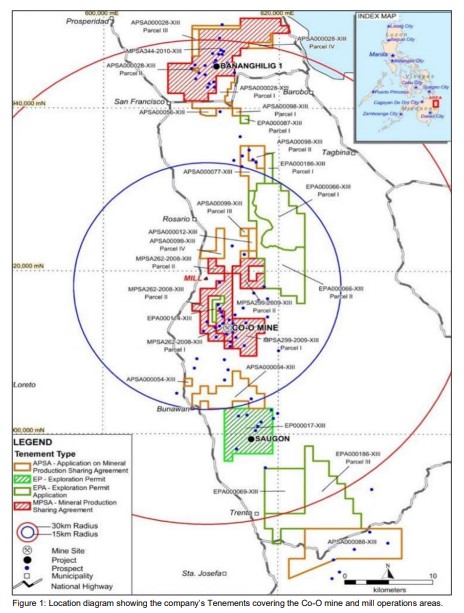

Tenement project overview:

The location of the Company’s Philippines Tenements is shown in Figure 1.

As at the end of the September 2020 Quarter, the Company’s tenement portfolio remained unchanged, having 17 tenement holdings with a combined area of 412 km2 (Figure 1 & Appendix B). This includes 4 granted tenements and 13 tenement applications. Of the granted tenements, 3 are currently in the exploration stage and 1, covering the Co-O Gold Mine, is in the operation stage.

The Company has undertaken sufficient exploratory works in EPA 00066-XIII, an area comprising of 6,769 hectares, to determine as non-prospective and is no longer part of the Company’s core assets. Documentation into the relinquishment of the area with the Mines & Geoscience Bureau is progressing.

Co-O Mine:

Production

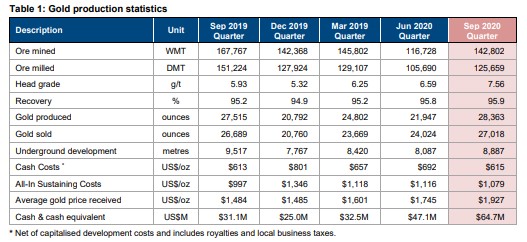

The production statistics for the September 2020 Quarter and comparatives for the previous four quarters are summarised in Table 1 below.

Table 1: Gold production statistics

The Company produced 28,363 ounces of gold this quarter, a 29% increase on the previous quarter due to mining at a higher head grade which places the year to date production marginally ahead of plan.

Production came from 125,659 tonnes of ore, processed at an average head grade of 7.56 g/t gold. Head grade was above plan and contributed to a reduction in AISC for the quarter compared to the previous quarter’s US$1,116 per ounce of gold.

Total underground development of 8,887 metres was achieved for the quarter, a 10% increase from the previous quarter and 7% overall ahead of plan. The majority of the vertical and horizontal development is at Level 10, while focused horizontal development continues on Levels 11 and 12.

FY2021 Guidance

Production guidance for the Co-O Mine for Financial Year 2021 (“FY21”) is expected to be between 90,000 ounces to 95,000 ounces at AISC of between US$1,200 to US$1,250 per ounce of gold produced.

The strong September quarter puts the Company marginally ahead of plan for both production and costs, and guidance remains unchanged at this stage.

Production shafts

Overall material hoisted was 140,629 dry tonnes (“DMT”) of ore and waste combined which is in line with expectations while COVID-19 work restrictions remain in place.

- Level 8 shaft:

The shaft achieved a total of 114,427 dry tonnes hoisted for the quarter, comprising 7,484 tonnes of waste and 106,943 tonnes of ore. Work continues on the systematic refurbishment of the L8 shaft to improve its longevity as a key piece of infrastructure at Co-O.

- Agsao inclined shaft:

Total material hoisted from Agsao Shaft totalled 20,870 tonnes, composing of 1,273 tonnes of ore and 19,598 tonnes of waste. A significant improvement in productivity was achieved in this quarter at 66% above plan.

- Baguio inclined shaft:

Baguio Shaft was placed on care and maintenance last quarter due to reduced manpower from COVID19 work restrictions and was scheduled to resume during the December quarter. However, an early easing of these restrictions enabled early resumption of production with 1,482 tonnes of ore hoisted.

- Portals:

Ore reserves from Level 1 and Level 2 are now depleted and the portals have been closed.

Level 8 Winzes:

The 29E, 12E, 43E and 48E Winzes continued to hoist ore and waste from Levels 9 and 10 to Level 8

Read more: Medusa Mining