Covid-19 cuts $280bn swathe through top 50 mining companies

By Frik Els

Image: CBC Youtube screengrab.

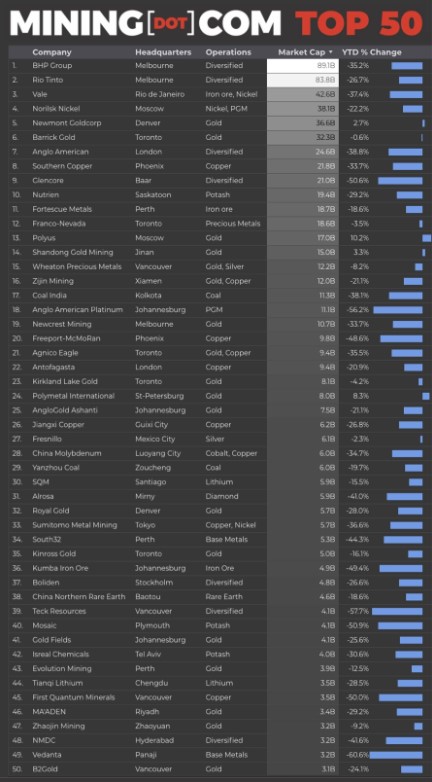

MINING.COM’s ranking of the world’s 50 largest mining companies based on market value shows a beleaguered industry at the end of the first quarter 2020 despite a resurgent gold price and robust precious metals M&A activity.

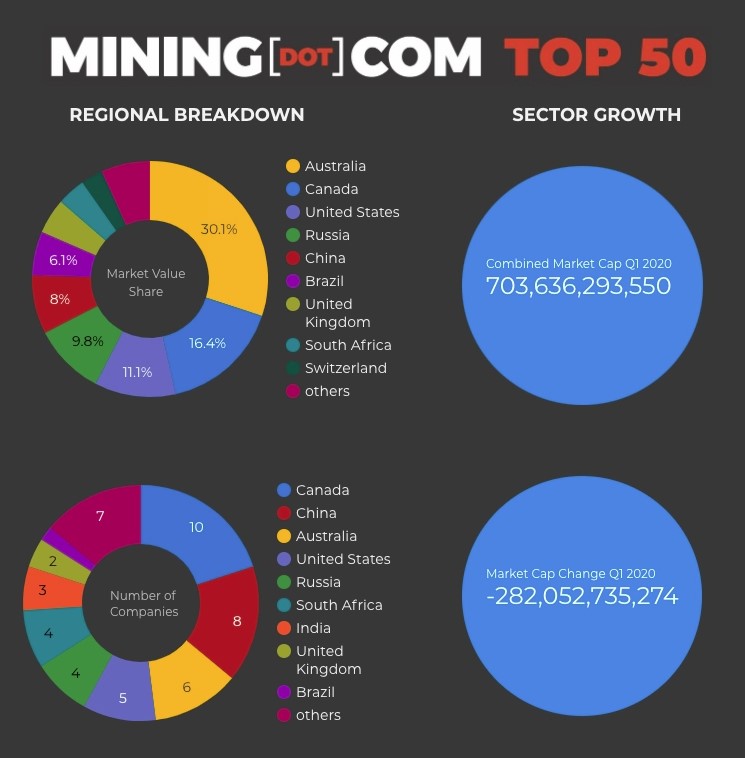

At the end of 2019, the MINING.COM TOP 50 had a combined market value within shouting distance of $1 trillion after adding nearly $160 billion in market capitalization over the course of the year. Three months into 2020, and $282 billion has been wiped from the sector as the covid-19 pandemic sweeps the world.

During this quarter the top 10 alone lost a combined $170bn in market value despite Newmont and Barrick holding steady on the back of a surging gold price. Among the big caps, Glencore’s bad run continues and the Swiss giant, with a 50% drop in market value, is now ranked the world’s ninth most valuable mining company – little over two years ago its top three spot seemed secure. Another prominent European name, Polish copper company KGHM, dropped out of the Top 50 altogether.

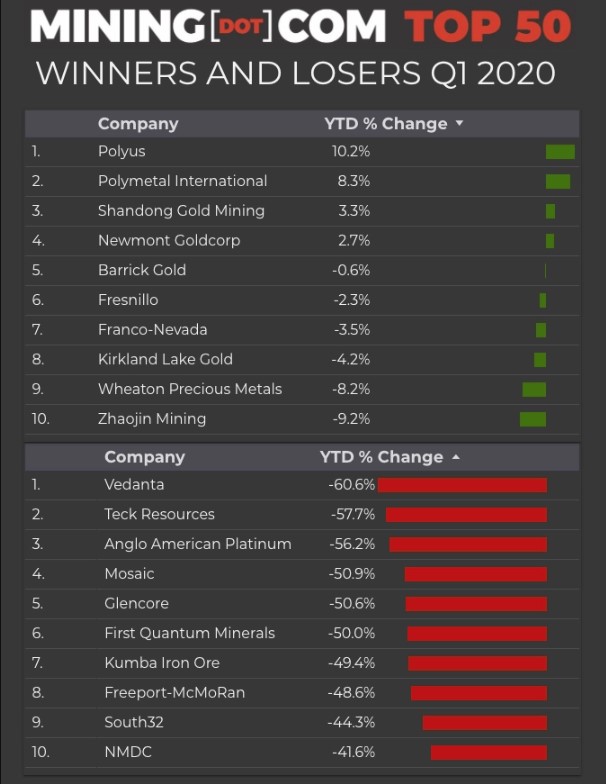

Russia’s largest gold producer, Polyus, was the quarter’s best performer and the only company with double-digit gains in dollar terms (it was up 50% in Moscow). St Petersburg-based Polymetal jumped 13 positions in the ranking and despite losing $7 billion potash giant Uralkali, Russian firms combined value climbed on a relative basis during the quarter, now constituting nearly 10% of the ranking.

Evolution Mining’s entry at no. 43 brings the number of Australian miners in the top 50 to six, while another newcomer from the gold sector, China’s Zhaojin Mining, increases the country’s tally to eight companies with a combined value of $56.5 billion.

Canada’s B2Gold became a Top 50 company for the first time, edging out top uranium miner Cameco for the final spot and bringing the number of gold companies in the ranking to 20. Combined, primary gold producers are worth $164 billion.

India’s majors also continue to struggle with industrial metals focused Vedanta dropping a whopping 16 places to no. 49 with a market value of $3.2 billion, joining Hyderabad’s NMDC at the bottom of the ranking. Vedanta has been on a wild ride, peaking at no. 12 in with a value north of $18 billion. The world’s largest coal producer, India Coal, was the world’s fourth most valuable mining company in 2016, but today languishes in the mid-tier.

Notes:

Source: MINING.COM, Morningstar, GoogleFinance, company reports. Trading data from primary-listed exchange where applicable, currency cross-rates 31 Mar 2020 vs 31 Dec 2019. *Percentage change based on US$ market cap difference, not exchange price in local currency.

As with any ranking, criteria for inclusion are contentious issues. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns the world’s largest gold mine, Eurochem, a major potash firm, trader Trafigura, top uranium producer Kazatomprom and numerous entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own minority stakes in mining assets be included, especially if these investments have no operational component or not even warrant a seat on the board?

This is a common structure in Asia and excluding these types of companies removed well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec. Levels of operational involvement and size of shareholding was another central consideration. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialized financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals.

What about diversified companies such as BHP or Teck with substantial oil and gas assets? Or oil sands companies that use conventional mining methods to extract bitumen for that matter? Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy where power, ports and railways make up a large portion of revenues pose a problem as does diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking as well as Kumba Iron Ore.

Chemical companies are also problematic – should Albemarle not be ranked because its potash and lithium operations are such a small part of its overall revenues? The same issue applied to FMC before it spun off its lithium business.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example BHP and Rio Tinto are shown as Melbourne, Australia but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.

Trading data from primary listing exchange and currency cross-rates at the date of publication. Market capitalization calculated at primary exchange, where applicable from total share outstanding, not only free-floating shares.

Please let us know of any omissions, deletions or additions to the ranking or suggest a different methodology.

Source: Mining dot Com