Colombia wants to become player in copper in next few years – government official

Reporting by Luis Jaime Acosta; Writing by Julia Symmes Cobb; editing by Grant McCool

BOGOTA – Colombia is looking to become a notable producer of copper within the next few years, the head of the national mining agency said, in a bid to diversify its mining output without neglecting production of coal and gold.

Mining in Colombia has historically been focused on large coal mines along its northern coast and relatively small scale gold and emerald operations in the Andes.

But following a 2016 peace deal between the government and the largest Marxist rebel group and interest from international miners, Colombia is looking to explore for new minerals in previously inaccessible areas.

“We have the potential, but we’re an unexplored country in terms of copper,” said agency president Silvana Habib in an interview on Thursday. “We’re located in a favorable geological environment, the Andean range, we share that copper belt with neighboring countries which are more advanced in copper.”

Initial estimates by companies show measured or indicated copper resources of close to three million tonnes and more than a million tonnes of potential reserves in provinces along Colombia’s northern and western coasts, Habib said.

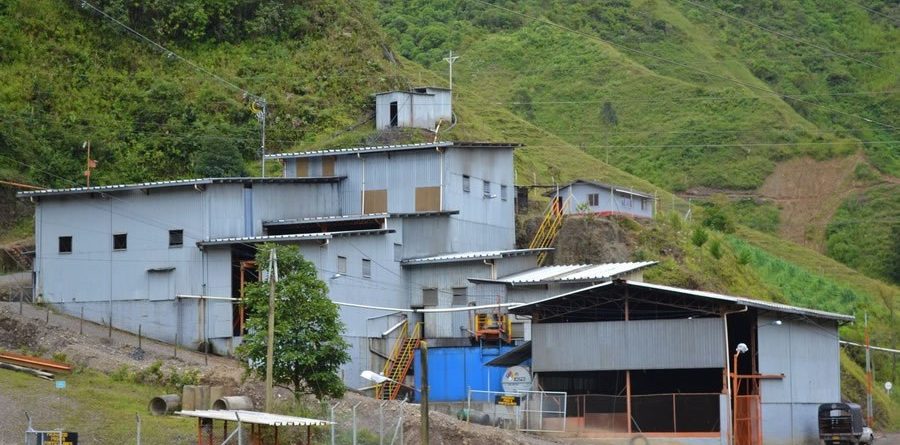

Pictured: Atico’s El Roble mine is the only producing copper mine in Columbia. Image by Atico Mining.

“We want to see ourselves in the ranking of copper-producing countries in the short and medium term,” she said.

Just one mine, Atico Mining Corp’s project in northwestern Choco province, is so far producing copper, Habib said, with an output of 10,000 equivalent tonnes per year.

AngloGold Ashanti Ltd, Cordoba Minerals and Minera Cobre are moving ahead with exploration work at their own sites.

Canada’s First Quantum Minerals Ltd owns a 10% stake in the Minera Cobre project in Choco, Habib said.

AngloGold’s Quebradona exploration has already faced local opposition similar to efforts which forced the company to abandon a $2 billion gold project in 2017.

Exploration work was briefly halted this year before a provincial environmental authority said it could continue.

Mining companies in Colombia have faced a raft of troubles from community votes to environmental restrictions.

But Habib said a 2018 court ruling that stops local votes from halting projects has given investors more security, and efforts to get community support and smooth licensing have been well received.

Meanwhile coal, Colombia’s second-largest source of foreign exchange, will remain important to the economy, Habib said.

Colombia, the world’s fourth-largest producer of coal, expects an output of 84 million tonnes this year, similar to last year’s despite a fall in international prices. Gold output is anticipated at 35 tonnes.

Source: MiningDotCom