Celsius Resources has a copper giant in a country where mining is set to boom

With strong support from the Philippine government, Celsius is on the fast track to developing its MCB copper-gold project. Pic: Getty Images

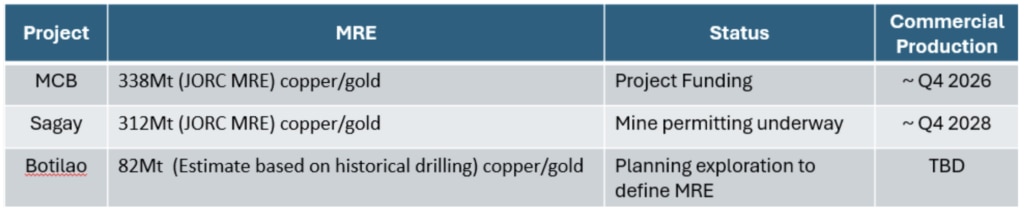

- Celsius Resources has JORC copper/gold Mineral Resource Estimates of 650Mt across its first two Philippines projects

- It received the first mining permit for a copper mine in the Philippines in almost 15 years

- Flagship MCB project projected with low costs, high recoveries and a head grade of over 1.1% copper for the first 10 years

- Expects to begin early works on the MCB project in Q4 2024, with production expected after 2.5 years

- Positioned as one of the leading cost effective, sustainable, high-grade, and long-life mining operators in the Asia Pacific region

Pic: Celsius Resources

Special Report: Celsius Resources is a multi-asset copper and gold resources company with a robust portfolio of geographically diverse projects in the Philippines, an increasingly attractive mining investment destination.

The Philippines has a rich mining history, but environmental, social and governance (ESG) concerns led to the imposition of a moratorium on new mining permits for nine years, starting in 2012. This moratorium allowed the government to implement stricter policies, processes, and conduct audits on existing mining operations to ensure full ESG compliance.

The restrictions were lifted on April 14, 2021, with the signing of Executive Order No. 130 by President Rodrigo Duterte. This action coincided with the commencement of development activities for the Celsius MCB Project, signaling a new phase in the country’s mining industry, where renewed investment and development were expected, albeit under stricter ESG regulations.

Celsius Resources (ASX:CLA) executive director Mark van Kerkwijk (MvK) told Stockhead that while it was the previous government that removed the moratorium, the current government under President Marcos is very supportive of mining and investors can be confident that the mining policy reforms ensure sustained support for the mining industry across administration lines.

“The Philippines desperately needs revenue from a sustainable mining industry to contribute to GDP growth, and the exploration, development and operating frameworks to achieve this is clearly laid out.”

“Many projects reside on tribal lands and the Philippines has a consent driven process for obtaining access to ancestral domain lands called Free and Prior Informed Consent (FPIC) which once formally agreed between all parties, provides all stakeholders stability for the life of the projects. Celsius’ in-country team has excelled in building relationships with all local stakeholders, providing the confidence that our projects will truly be delivered sustainably in a way that will benefit the local communities and stakeholders.”

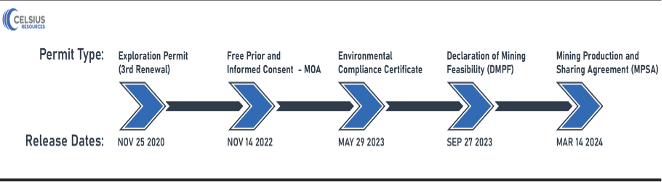

The team has methodically worked through the permitting process during the last few years and has demonstrated that a collaborative and trustworthy approach can achieve what many have said was impossible; compared to many other jurisdictions, the permitting achievements have been executed in record time. The steps outlined below reflects the amount of hard work that has gone into each stage.

Pic: Celsius Resources

Multi generational copper/gold resource

A supportive, pro-mining regime is only one part of the story.

The company describes itself as a multi-asset copper-gold company with a timeline of projects that naturally progress one after another and a hefty 650Mt of JORC resources contained within just the first two projects – the flagship Maalinao-Caigutan-Biyog (MCB) Project in Luzon and the Sagay Project in the Negros Island.

“Amongst these two projects we have multi-generations’ worth of copper and gold,” MvK said.

The MCB Project. Pic: Celsius Resources

The 2,500-hectare MCB mining tenement is located 320km north of the Philippine capital of Manila and is the subject of a mining permit issued in March this year which grants CLA’s affiliate company, Makilala Mining Company Inc. exclusive rights to carry out exploration, development and commercial production for 25 years, with a renewal option for another 25-years.

MCB is a classic porphyry-style copper-gold deposit with a high-grade, sub-vertical core that represents about 28% of the total resource, which stands at 338Mt grading 0.47% copper and 0.12g/t gold (1.6Mt of contained copper and about 1.3Moz contained gold).

“The reason why I’m excited to be part of Celsius is that it has a fantastic project (MCB) containing a granite intrusion-based porphyry which will support safer underground mining operations and a high-grade core,” MvK noted.

“We have an initial 25-year mine plan that targets an ore reserve which is only ~15% of the total resource. The first 10 years of operations will process a head grade of copper greater than 1.1% with enough gold credits to really reduce the cost base.”

“Our conservative model projects C1 costs of around US56c/lb for the first 10 years, with it rising to a projected $1.11 over the life of the mine, which is very competitive especially when we don’t need to keep spending money on exploration in the future, so the overall costs are going to stay low.”

Outstanding economic potential of MCB project

MCB is the subject of a Mining Project Feasibility Study (not too dissimilar to a Bankable Feasibility Study in Australia) that sees it being developed through a sub-level, open stoping mining method with the waste being mostly paste backfilled and dry stacked. Remarkably, this project will not have a tailings dam which is a more environmentally sustainable approach.

Ore from MCB will feed a single processing train with nameplate capacity of 2.4 million tonnes per annum. The planned processing rate will be 2.28Mtpa to generate 90,000t of concentrate per annum containing 22,000t of copper and 27,000oz of gold.

This is designed with the ability to increase capacity to 4.5Mtpa given the right economic conditions.

Initial Capex is estimated at US$254.7m with payback estimated in 2.67 years from peak negative. The project is expected to deliver robust economics due to the high grades and low-cost operating environment.

MvK added the company has been very conservative about modelling the economics with a NPV discount rate set at 12% and any expected reduction of the cost of capital will significantly improve the project economics.

Typically, many companies pitch projects with NPV discounts of ~8%, while some are drawn up at lower rates to improve the economic picture.

“From discussions with most of the financiers globally, they have the expectation that we should really run a 12% discount rate when pitching these projects and that’s what the company has implemented.” MvK said.

“While we have been conservative, we are confident that our current funding plan will result in a WAAC (Weighted Average Cost of Capital) of much lower than 12% in the end. We are looking to under promise and over deliver.”

Next cab off the rank

The Sagay Copper-Gold Project. Pic: Celsius Resources

While MCB is undoubtedly the focus of the company’s efforts, the next project in line – Sagay – has the potential to add significantly to its copper-gold production.

Of similar size, if lower grade, the ~1,780-hectare Sagay Project is a large-scale, deep porphyry with a shallow, secondary supergene deposit to the west that has a resource of 312Mt at 0.39% copper and 0.11g/t gold, or contained resources of ~1.2Mt copper and ~1Moz gold.

Notably, the shallow supergene copper zone offers the opportunity for a low-cost start-up opportunity.

A feasibility study was carried out to evaluate the technical and financial viability of the shallow supergene deposit found the proposed processing plant will only require gravity separation to extract copper concentrate.

Metallurgical test work has indicated the tails produced is non-acid-generating, meaning that, like MCB, tailings can be managed through dry stacking which will be utilized for environmental rehabilitation, eliminating the need for a tailings dam.

MvK noted Sagay is about 18-24 months behind MCB, while non-executive director Peter Hume indicated that initial capex for Sagay would be much cheaper than MCB and could generate cash for the development of the Sagay porphyry deposit.

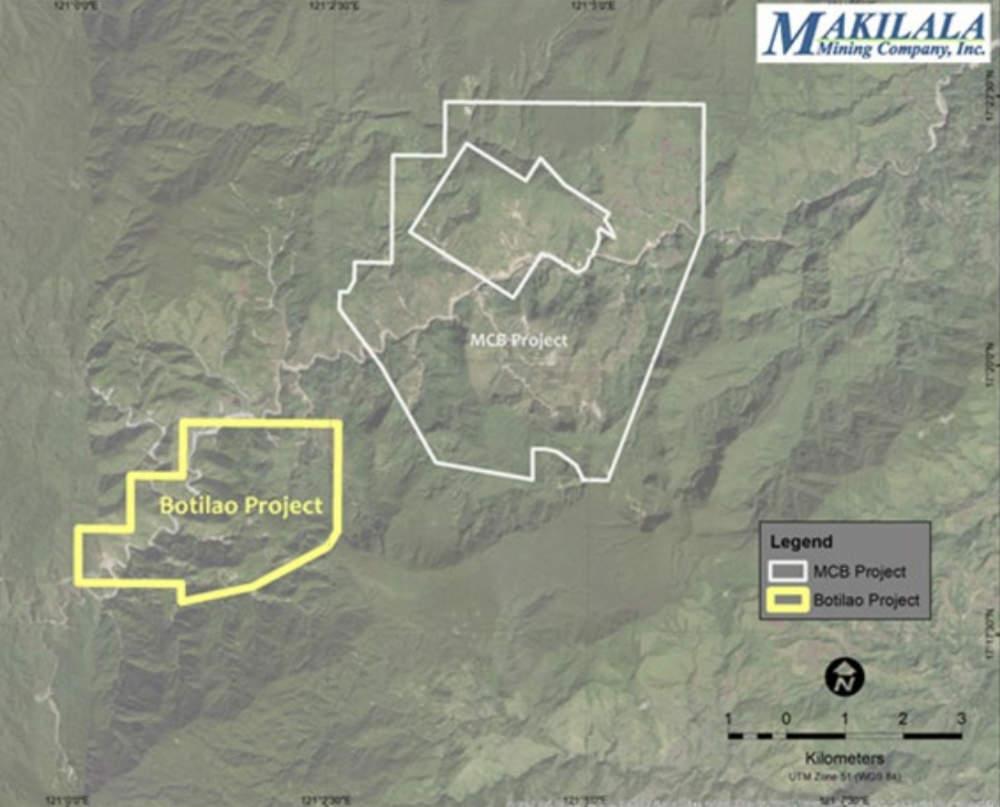

The Botilao Project is in close proximity to the MCB project. Pic: Celsius Resources

The third project of note is the 947-hectare Botilao copper-gold project where previous exploration by Lepanto Exploration Asia in the 1970s determined the presence of copper-gold mineralisation in the area with copper grades up to ~1%.

During the June 2024 quarter, the company focused on historical data analysis, remote sensing and planning for reconnaissance mapping and sampling.

The road ahead

Given the advanced nature of the MCB project and the supportive regime, MvK is confident the company will be able to demonstrate a clear project funding model to begin early works in Q4 2024

“We expect in the near future to be fully funded to production with a very strong partner but we will only announce fully approved and binding agreements once they have been executed,” he said.

MvK added that the company has been dealing with a number of highly prospective parties and expected to fully fund development using a combination of equity and debt at the project level.

The company also expects to secure within the month, the key FPIC Certification Precondition. Arguably, it is one of the most stringent approval milestones for a new project to achieve. The legally binding agreement is the culmination of many steps of stakeholder engagement and requires broad community consent, from the local indigenous population through to their recognized tribal leadership. The government, through the National Commission on Indigenous Peoples, ascertains that the FPIC is carried-out with respect to the Indigenous Peoples “right to self-determination”.

“We have an experienced local team, an excellent resource, excellent quality and high-grade ore, plus significant gold credits to really drive down the cash costs. Potential customers have already evaluated our output to be highly marketable copper/gold concentrate and some have even gone as far to submit offtake expressions of interest.” MvK said.

“We have cheap electricity at 4c/Kwh, plenty of water and access to government owned port facilities at Salomague, which is ~ 180km from the mine site. Concentrate will be delivered to port via road in 20ft containers.

“We are now on a journey to build confidence in the commissioning and maintain the integrity of the company and its projects and focus on the makeup of the share register too. As we get closer to production, there is anticipation of very healthy dividends flowing through to shareholders.”

This article was developed in collaboration with Celsius Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Source: The Australian