B2Gold Announces Updated and Significantly Increased Mineral Resource Estimate for the Anaconda Area, Located Near the Fekola Mine, Mali

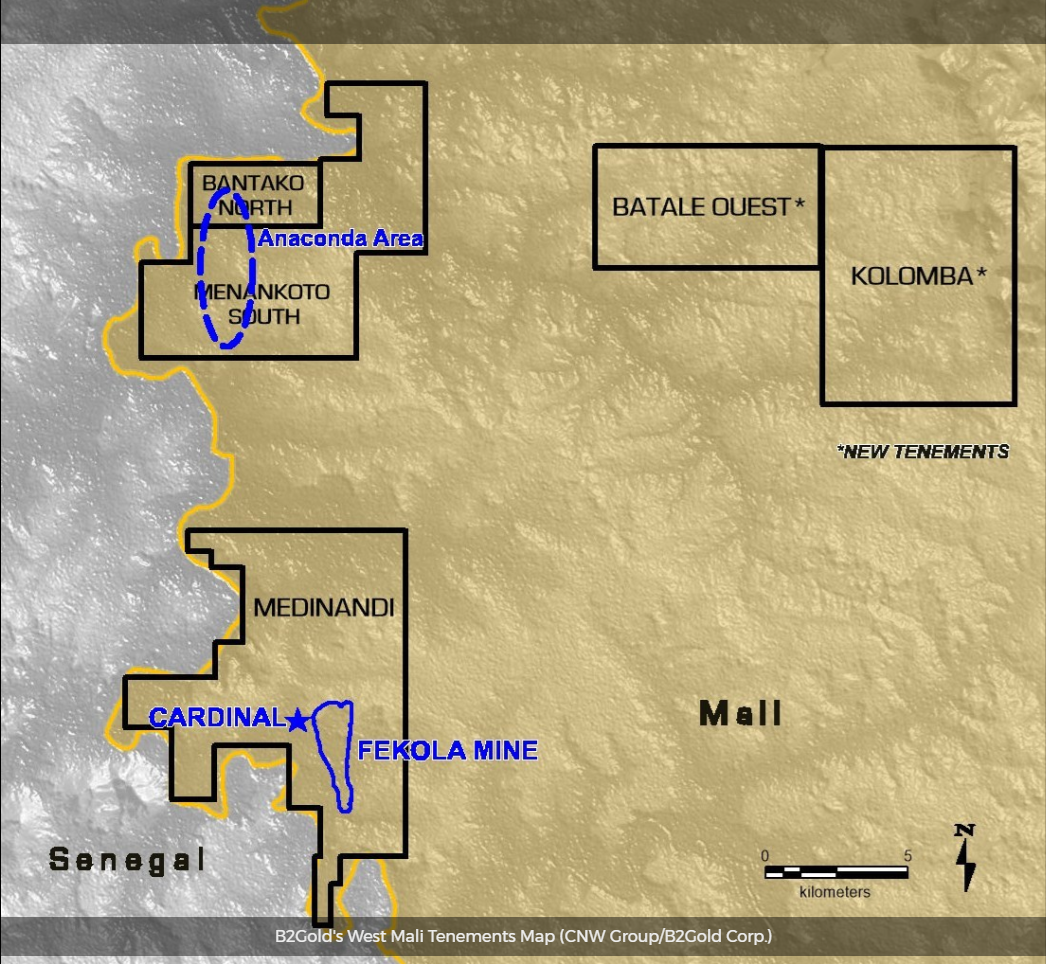

VANCOUVER, BC, March 23, 2022 /PRNewswire/ – B2Gold Corp. (TSX: BTO) (NYSE AMERICAN: BTG) (NSX: B2G) (“B2Gold” or the “Company“) is pleased to announce an updated and significantly increased Mineral Resource estimate for the Anaconda area, comprised of the Menankoto permit and the Bantako North permit, located approximately 20 kilometres from the Fekola Mine, including initial estimates for oxide Indicated Mineral Resources and sulphide Inferred Mineral Resources. Based on the updated Mineral Resource estimate and B2Gold’s preliminary planning, the Company has demonstrated that an open pit situated on the Anaconda area could provide selective saprolite material (average grade of 2.2 grams per tonne (“g/t”)) to be trucked to and fed into the Fekola mill commencing as early as late 2022, subject to obtaining all necessary permits and completion of a final development plan.

B2Gold’s West Mali Tenements Map (CNW Group/B2Gold Corp.)

Highlights:

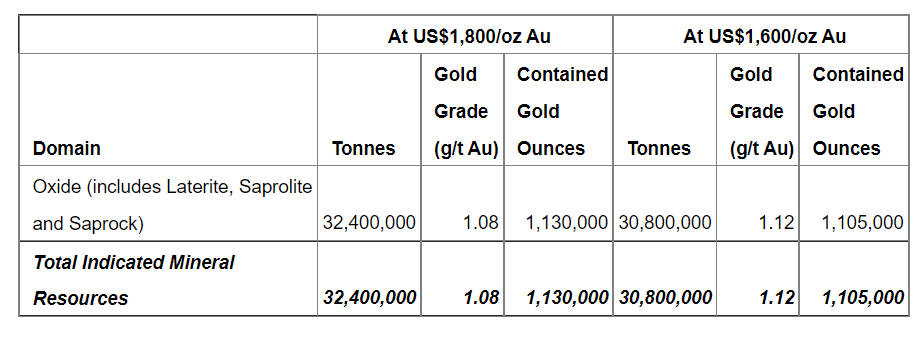

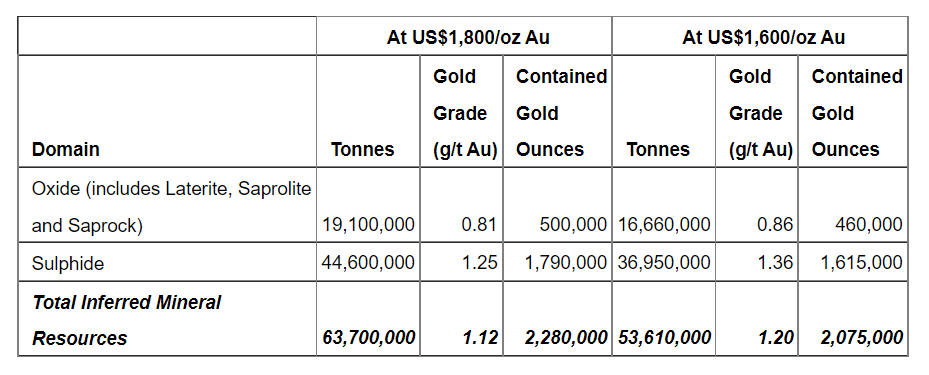

- Updated and significantly increased Mineral Resource estimate (as at January 11, 2022) constrained within a conceptual pit shell at a gold price of US$1,800 per ounce includes an initial Indicated Mineral Resource estimate of 32,400,000 tonnes at 1.08 g/t gold for a total 1,130,000 ounces of gold, and Inferred Mineral Resource estimate of 63,700,000 tonnes at 1.12 g/t gold for 2,280,000 ounces of gold

- The Mineral Resource estimate includes first time reporting of 1,130,000 ounces of Indicated Mineral Resources and an increase of 1,510,000 ounces (196% increase) of Inferred Mineral Resources since the initial Inferred Mineral Resource estimate in 2017 (21,590,000 tonnes at 1.11 g/t gold, for 767,000 ounces)

- Mineral Resource estimate (as at January 11, 2022) constrained within a conceptual pit shell at a gold price of US$1,600 per ounce includes an initial Indicated Mineral Resource estimate of 30,800,000 tonnes at 1.12 g/t gold for a total 1,105,000 ounces of gold, and Inferred Mineral Resource estimate of 53,610,000 tonnes at 1.20 g/t gold for 2,075,000 ounces of gold

- Ongoing drilling to infill and extend the saprolite resource area and to follow up on the sulphide mineralization at the Anaconda area, including the Mamba and Adder zones, as well as several other targets below the saprolite mineralization. The good gold grade and width combinations at the Anaconda area continue to provide a strong indication of the potential for Fekola-style south plunging bodies of sulphide mineralization, which remains open down plunge below the saprolite

- US$33 million budgeted in 2022 to fund development of infrastructure for Phase I saprolite mining at the Anaconda area, including road construction

Mineral Resource Estimate

(as at January 11, 2022, reported on a 100% basis)

Indicated Mineral Resources (including US$1,600/oz Au sensitivity case)

Inferred Mineral Resources (including US$1,600/oz Au sensitivity case)

Inferred Mineral Resources (including US$1,600/oz Au sensitivity case)

Notes:

Notes:

- The Qualified Person as defined under National Instrument 43-101 for the Mineral Resource estimate is Tom Garagan, P.Geo., B2Gold’s Senior Vice President, Exploration.

- Mineral Resources have been classified using the 2014 CIM Definition Standards. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are reported on a 100% basis. For the Menankoto permit area, B2Gold has an 85% attributable interest; under the applicable Malian mining legislation, the State of Mali has a 10% free-carried interest with an option to acquire an additional 10% participating interest, and 5% is held by a Malian third party. For the Bantako North permit area, B2Gold has an 80% attributable interest; under the applicable Malian mining legislation, the State of Mali has a 10% free-carried interest with an option to acquire an additional 10% participating interest, and 10% is held by a Malian third party.

- Mineral Resource estimates for the Anaconda area assume an open-pit mining method. Pit shells were run using a gold price of US$1,800/oz, metallurgical recovery of 94%, selling cost of US151.00/ounce produced which includes royalties, operating cost estimates of US$0.97-US$2.00/t mined (mining at surface) plus a sinking rate of US$0.035/10 metres depth, US$8.37-US$13.11/t processed (processing), US$3.50/t processed (hauling) and US$2.33/t processed (general and administrative).

- Mineral Resources are reported at a cut-off of 0.3 g/t gold for oxide material and a cut-off of 0.4 g/t gold for sulphide material.

- All tonnage, grade and contained metal content estimates have been rounded; rounding may result in apparent summation differences between tonnes, grade, and contained metal content.

Anaconda Area Development

In 2022, the Company has budgeted US$33 million to fund development of infrastructure for Phase I saprolite mining at the Anaconda area, including road construction. Based on the updated Mineral Resource estimate and B2Gold’s preliminary planning, the Company has demonstrated that a pit situated on the Anaconda area could provide selective higher grade saprolite material (average grade of 2.2 g/t) to be trucked to and fed into the Fekola mill commencing as early as late 2022 at a rate of 1.5 million tonnes per annum. Subject to obtaining all necessary permits and completion of a final development plan, the trucking of selective higher grade saprolite material to the Fekola mill would increase the ore processed and annual gold production from the Fekola mill, with the potential to add an average of approximately 80,000 to 100,000 ounces per year to the Fekola mill’s annual gold production. The plan to truck the selective higher grade saprolite material is not included in the Company’s 2022 production guidance and the Anaconda area Mineral Resources have not been included in the current Fekola life of mine plan.

Based on this updated Mineral Resource Estimate and the 2022 exploration drilling results, the Company has commenced a Phase II scoping study to review the project economics of constructing a stand-alone mill near the Anaconda area. Subject to receipt of a positive Phase II scoping study, the Company expects that the saprolite material would continue to be trucked to and fed into the Fekola mill during the construction period for the Anaconda area stand-alone mill. The two sensitivity cases outlined in Schedule A demonstrate the upside potential for a possible stand-alone mining and milling project at the Anaconda area. The first sensitivity case includes zones within the Anaconda area reported above a cut-off of 0.6 g/t gold within the pit shell used for reporting Mineral Resources. The second sensitivity case includes Mamba and Cascabel zones only reported above a cut-off of 0.6 g/t gold within the pit shell used for reporting Mineral Resources.

This additional feed from the Anaconda area to the Fekola mill has the potential to provide immediate value to B2Gold and the State of Mali, B2Gold’s partner at the Anaconda area, and communities near the project, and create significant long-term benefits for the Government of Mali as well as employment opportunities and value generation for the communities located both near the Menankoto deposit, regionally and nationally.

Anaconda Area 2021 Exploration Program

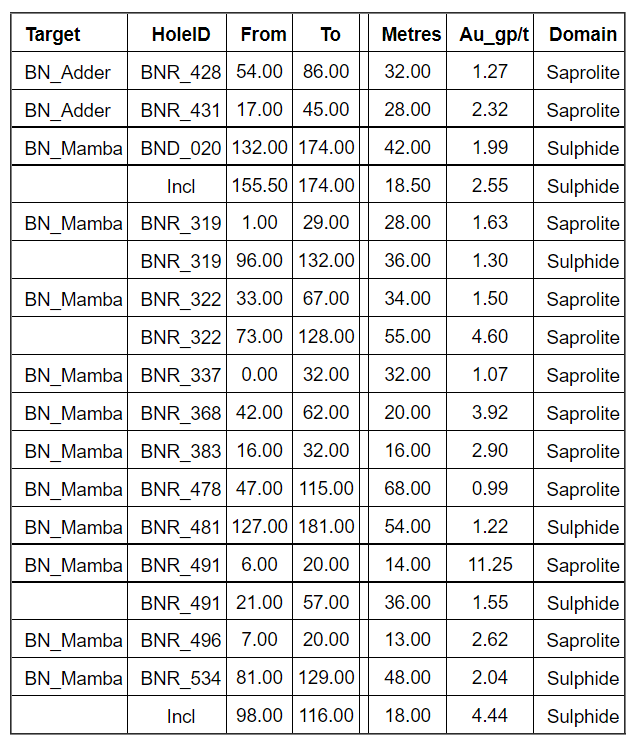

In 2021, the Company incurred US$27 million in exploration expenditures in Mali, with approximately US$12.7 million focused on the ongoing exploration of the Anaconda area to complete approximately 57,000 metres of combined reverse circulation and diamond drilling. Drilling focused almost entirely on the Bantako North portion of the Anaconda area. The 2021 exploration program combined growth through step out exploration holes with the infill of previously defined mineralized zones, in preparation for the updated Mineral Resource estimate for the Anaconda area. Drilling at the Anaconda area commenced in January 2021, with two drill rigs completing step-out drilling at the Mamba zone. One of the key geological features of the Mamba zone is the continuity in the high-grade mineralization through the transition from saprolite- to sulphide-hosted zones of mineralization and the 2021 continues to demonstrate this aspect. The 2021 drilling has increased the known strike extent of the Mamba zone to over 3.2 kilometres.

Expansion of the known saprolite and sulphide resources at each of the Adder, Cascabel, Viper and Mamba zones was the priority of the exploration program in 2021. The most significant intersections are from Adder and Mamba and a table of some selected and representative results, highlighting the success of the additional drilling, is presented in the following table.

Sulphide composites are reported above 0.6 g/t gold cut-off; Saprolite composites are reported above a 0.2 g/t gold cut-off.

Additionally, the Company has completed environmental and social studies to support permitting efforts.

Anaconda Area 2022 Exploration Program

The 2022 Mali exploration program, with a budget of approximately US$28.4 million, is currently underway, including approximately US$12 million focused on exploration drilling at the Anaconda area. In 2022, the Company will continue drilling to infill and extend the saprolite resource area and to follow up on the sulphide mineralization at the Anaconda area, including the Mamba and Adder zones, and several other targets below the saprolite mineralization. The good grade and width combinations at the Anaconda area continue to provide a strong indication of the potential for Fekola-style south plunging bodies of sulphide mineralization, which remains open down plunge. Five drill rigs are currently drilling in the Anaconda area.

In addition to the drill holes outlined above, holes BND_040 (2.1 g/t gold over 23.1 metres, from 252.9 metres) and BND_048 (1.85 g/t gold over 24.8 metres, from 127 metres) are recent examples of significant sulphide drill results below the limits of the current Mineral Resource pit and provide excellent potential for follow up targets for further exploration.

At the Mamba zone, approximately 500 kilograms of sulphide mineralization drilled in the 2019-2021 drilling campaigns has been selected for metallurgical recovery and comminution testing. Samples selected for testwork represent various ranges in grade and mineralogy across the deposits and were taken from sample preparation coarse rejects.

Resource Model Methodology

The updated Anaconda area Mineral Resource models were prepared in-house by B2Gold personnel. Drilling completed in support of the Mineral Resource estimate includes 302 diamond drill holes (60,565 metres), 1,435 reverse circulation holes (178,147 metres) and 2,769 aircore holes (120,524 metres) for a total of 4,506 drill holes (359,236 metres).

Mineralization and weathering domains were modeled in three-dimensions with mineralization domains used to control estimation of gold grades. Laterite, saprolite and saprock were modeled using logged weathering and lithology codes. Mineralization within the weathered profile is interpreted as an extension to underlying sulphide mineralization. The main controls on sulphide mineralization are west-dipping shear zones with an underlying lithological and alteration component.

Assays were capped by mineralization domain, with capping ranging from 1.5 g/t to 2.5 g/t gold in the low grade zones, 3.0 g/t to 4.0 g/t gold in the medium grade zones and 12.0 g/t to 27.0 g/t gold in the high-grade zones. Gold grades were capped prior to compositing to 2 metres. Grades were estimated into the block models using Ordinary Kriging with searches dynamically controlled along main mineralization zone directions.

Approximately 15,400 bulk density measurements were made at site on drill core samples using the Archimedes water-displacement method. Average densities by weathering type were applied to the model. Nominal drill hole spacing for saprolite and saprock Indicated Mineral Resources is aircore drilling at 40 x 40 metres and reverse circulation or core drilling at 80 x 80 metres, and for Inferred Mineral Resources drill hole spacing is nominally 80 x 80 metres.

QA/QC on Sample Collection and Assaying

The primary assay laboratory for Bantako North and Menankoto exploration samples is SGS Laboratories in Bamako, Mali. The Fekola Mine laboratory and Bureau Veritas laboratories in Abidjan, Cote d’Ivoire, have served as alternate laboratories. At each laboratory samples are prepared and analyzed using 50-gram fire assay with atomic absorption and/or gravimetric finish. Umpire assaying of exploration samples is conducted on a quarterly basis. SGS Bamako is accredited under ISO17025 and is an independent laboratory. The Fekola Mine laboratory currently holds no accreditations and is not independent of B2Gold. Bureau Veritas Abidjan laboratory is independent of B2Gold and is operating to the guidelines of ISO9001 and ISO17025 protocols in accordance with procedures specified within the Bureau Veritas group.

Quality assurance and quality control procedures include the systematic insertion of blanks, standards and duplicates in the sample sequence. The results of the control samples are evaluated on a regular basis with partial batches re-analyzed and/or resubmitted on exploration samples, as needed. All results stated in this announcement have been accepted according to B2Gold’s quality assurance and quality control protocols.

Qualified Person

Tom Garagan, Senior Vice President of Exploration at B2Gold, a qualified person under National Instrument 43-101, has reviewed and approved the information contained in this news release.

About B2Gold Corp.

B2Gold is a low-cost international senior gold producer headquartered in Vancouver, Canada. Founded in 2007, today, B2Gold has operating gold mines in Mali, Namibia and the Philippines and numerous exploration and development projects in various countries including Mali, Colombia, Finland and Uzbekistan. B2Gold forecasts total consolidated gold production of between 990,000 and 1,050,000 ounces in 2022.

On Behalf of B2GOLD CORP.

“Clive T. Johnson”

President & Chief Executive Officer

For more information on B2Gold, please visit the Company website at www.b2gold.com or contact:

Source: PR Newswire