Mining’s unlikely heroines – Greta Thunberg and AOC

By Frik Els

Exponential expansion of global mining is the dirty little secret – and glaring blind spot – of Green New Deal evangelists and zero-carbon climate warriors

Composite of Greta Thunberg (August 2018) and New York Rep. Alexandria Ocasio-Cortez (March 2019). Images by Anders Hellberg (Wikimedia Commons) and nrkbeta (Flickr)

Leftwing darling Alexandria Ocasio-Cortez’s proposed Green New Deal, despite its flimsy 14 pages total, is nothing if not all-encompassing and vaulting in its ambition. The bill was also crucial to Ocasio-Cortez’s rapid ascent to acronym status and anointing as the queen of green.

Thanks to her How Dare You tour, 16-year old Greta Thunberg is now the undisputed leader of the growing ranks of school-bunking climate crisis warriors all over the world.

“THE FOOTSLOGGING GRETA GROUPIES ARE BEGINNING TO RESEMBLE THE DISASTROUS 1212 CHILDREN’S CRUSADE – WITH HIGHER GROUND NOW DOING SERVICE FOR HOLY LAND”

The Greta show arrived in MINING.COM’s hometown of Vancouver last week to take Make-Love-Not-CO2 youths (and second-life hippies) on yet another march and bridge-blockade. The footslogging Greta groupies are beginning to resemble the disastrous 1212 children’s crusade – with higher ground now doing service for holy land.

Much of the response to AOC and Thunberg (who seem to get on like a house on fire if the Guardian is to be believed) on the right has been mocking and dismissive, accusing the pair of swapping hamburgers for pie in the sky.

This is a mistake.

Red turns green

Some estimates put the green economy in the US at $1.3 trillion in annual revenue already – that’s 7% of GDP – with a workforce of 9.5m Americans.

Within the Green New Deal is a goal of “meeting 100% of the power demand in the United States through clean, renewable, and zero-emission energy sources”. AOC has no deadline of course, but no doubt Greta would want that for the whole world before she hits drinking age.

Alexandria Ocasio-Cortez launches Green New Deal in front of the Capitol Building in February 2019

A seminal paper by Bernstein’s European mining and metals team led by Paul Gait outlines just how fundamental a restructure of the global industrial economy is necessary to bring this – or even a fraction of this – about.

And all of it to the great benefit of mining.

Copper and the Green Economy – Thoughts from [Bernstein’s] decarbonisation conference has only been passed around in mining circles for a few weeks, but the “Greta scenario” outlined in the research has already become shorthand for what a brave new world of mining may look like.

Equally eye-popping is another possible scenario sketched in the report: when the target date is pushed out to 2070 it would require investment in copper roughly equal to the total known reserve base of 647 million tonnes. The required copper price of $20,000 a tonne ($9/lbs or more than three times today’s level) under Bernstein’s Greta scenario of full decarbonisation by 2025, certainly is a headline grabber.

“IF THE FIRST INDUSTRIAL REVOLUTION WAS POWERED BY DARK SATANIC MILLS, COPPER’S RED HOT SMELTERS WILL DRIVE THE GREEN REVOLUTION”

Keep in mind those are the additional tonnes just for renewable energy networks and electric cars that comes on top of the 20 million tonnes of annual copper consumption in other industrial sectors.

If the first industrial revolution was powered by dark satanic mills, copper’s red hot smelters will drive the green revolution.

This is still your great-great-grandfather’s copper mine

Captain Copper, superhero created to teach kids about the metal, by Chile state miner Codelco

The Green New Deal is full of big numbers.

Here’s another one: Producing that amount of copper would require blasting, crushing and grinding 130 billion with a B tonnes of rock at current ore grades.

And those grades will only continue to fall over the next 50 years, not least because the average weighted age of the world’s 20 largest copper mines is 91 years.

Climate change is pitting generations against each other (Google “OK Boomer” for more). Ageing copper mines puts a whole new spin on it.

How soon is now?

Even Bernstein’s base case of gradual decarbonisation under the 2015 Paris targets (more honoured in the breach than the observance, particularly in North America) requires a 50% lift in the price of copper to incentives new mines.

Yet when I checked this morning, copper was languishing not far off two-year lows despite Chile doing a Hong Kong (Chile is not the Saudi Arabia of copper, it’s the Saudi-Iran-Iraq-Emirates of copper), deepening deficits, dwindling ranks of explorers and a dearth of major projects.

“WHEN WE HIGHLIGHT THE IMPACT OF DECARBONISATION ON COPPER PRICES THERE IS ABSOLUTELY NO SENSE IN WHICH THIS CAN BE TAKEN TO IMPLY THAT WE ‘CANNOT AFFORD’ TO DELIVER A GREEN ECONOMY”

Paul Gait – BERNSTEIN

A tenth of the world’s copper mines are already under water and that’s in no small part due to weak prices of copper byproduct crucial to any green new deal like cobalt, still two-thirds off its peak despite closure of world’s biggest Cu-Co mine.

It’s not going well for other essential green energy raw materials either. Inventors of the lithium-ion battery won a Nobel this month. Lithium prices are down 58% in the last 18 months. If you’re picking up flake graphite, it’s down 20% from last year. Nickel nerds are happy, but for how long?

The powder is staying dry

Unsurprisingly, AOC and the Green New deal does not once mention mining. AOC accepted an invitation from a congressman to visit a working Kentucky coal mine, but the stunt fell through – because… wait… there are no coal mines left in the district.

Thunberg’s only mining pronouncements have been in support of German coal and Turkish gold protests.

It’s not just the green lobby – and wittingly or unwittingly their donors – that have a blind spot when it comes to mining.

Investors are shunning the sector too. And overwhelmingly in favour of fossil fuel.

Private capital dedicated to natural resource investment have assets under management of $689 billion according to a Preqin report. Mining’s share? $19.9 billion.

According to the private capital tracker, the 216 funds currently raising money for investment in energy assets – almost all of it destined for North American oil and gas – bagged $7.9 billion during during the third quarter to add to the $191 billion on hand.

The 15 funds looking for mining and metals investors could not raise a cent in the third quarter and dry powder (money ready to be invested) is less than $5 billion, which would not cover the outlay for a single large-scale copper mine.

TikTok, time’s up

Public markets are hardly more accommodating.

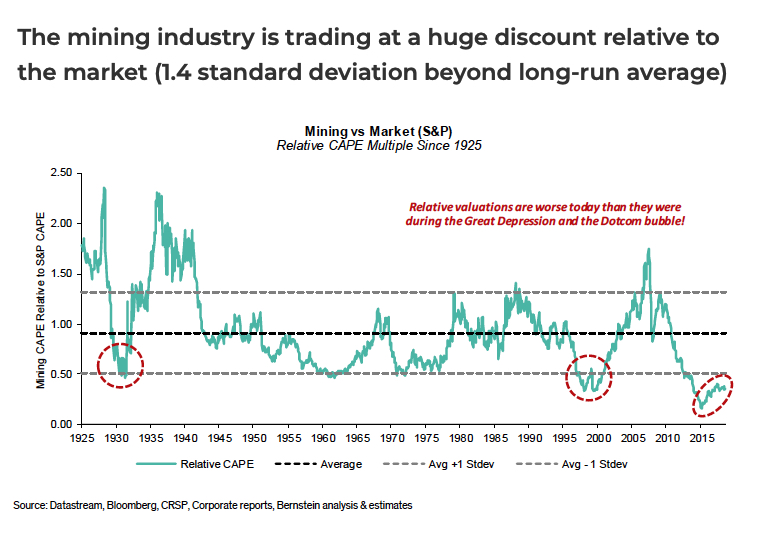

In an earlier report Bernstein applied a measure – the Cyclically Adjusted PE (CAPE) multiple – to the mining sector going back a century to establish the relative valuation to equities.

The chart shows that the much-admired mining industry rerating since end-2015 is more akin to a death rattle than a recovery.

“THE MATH MAY BE HARD (SEE FORMULA) BUT THE MESSAGE CANNOT BE SIMPLER”

And we’ve been here before, laments Gait:We live in a world where TikTok (ask your tween) is valued at twice as much as Glencore, the world’s largest commodities trader with annual revenues of $220 billion.

Of course, the misallocation of capital to non-productive, pseudo-economic activities also occurred during the previous period of blatant relative undervaluation – the dotcom bubble – and is parallel to what we are seeing today.

Cutting emissions doesn’t cut it

Virtue signalling by touting desalination plants, solar-powered ops and electric dump trucks does not provide green credentials any more. To be frank, projects like these are now most often undertaken because it’s cheaper or there’s no alternative.

Sprinkling protect-the-planet messaging in marketing and making (often tenuous) claims about the clean-tech properties of products don’t cut it either.

Go nuclear or go extinct. Protestors at Greta Thunberg rally downtown Vancouver, October 25, 2019 Image: MINING.COM

If this was a successful strategy, platinum miners would be stocking Sierra Club’s board and environment-sensitive investors would be lining up to give uranium explorers money.

(Climate activists’ opposition to nuclear power leads to cognitive dissonance on the left and popular shows like HBO’s Chernobyl, which remained mostly unmolested by science over its five episodes, means the error won’t be corrected soon.)

I feel the earth move

Every tonne of copper embedded in the global economy has the potential to remove ~500 tonnes of CO2 per annum, according to Bernstein.

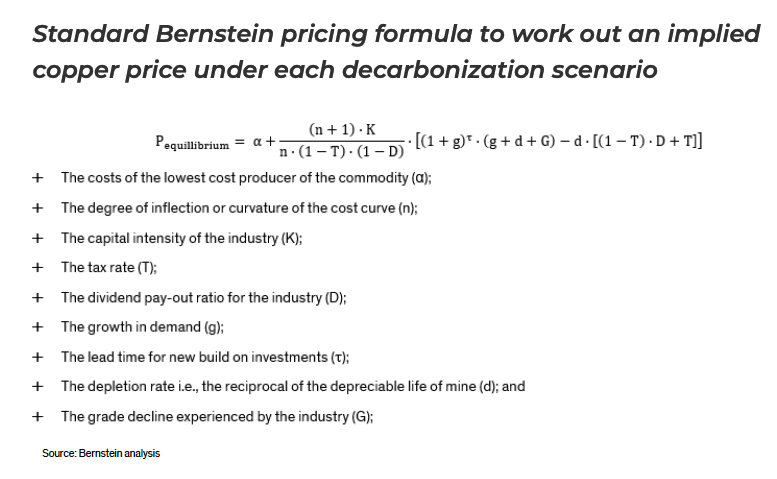

The math may be hard (see formula), but the message cannot be simpler.

There is no green economy without copper (and nickel, cobalt, vanadium, praseodymium… go down the periodic table if you must).

Big Mining has failed to grasp the opportunity presented by climate change.

At the moment, mining is lumped together with oil and gas as just another “extractive” industry “exploiting” natural resources.

Going all in on the green economy and decarbonisation requires siding with the greens against fossil fuels.

It means selling global mining as the solution to climate change because mining metals is the only path to green energy and green transport.

(Big Mining’s biggest blunders usually have to do with oil anyway… ask BHP and Freeport).

There are other ways mining will benefit from a wholehearted embrace of climate change goals.

Attracting young workers to the industry is a serious and growing problem for miners, but what Gen Z or Millennial would say no to travelling the planet (by sailboat or solar plane where possible of course) and fighting global warming at the same time.

Mining monopsony

A concerted and concentrated effort to decarbonise the planet rapidly will also reduce the mining industry’s reliance on China as virtually the sole driver of global metal demand and spread it more evenly across the world.

The first signs of a more diverse demand base can be seen in the shift to electric vehicles (itself the biggest change in the auto industry in 100 years) as battery megafactories spring up in Europe and giant solar farms and storage centers spread across South America and Africa.

And given rising tensions, there is probably greater willingness in the West to ensure that during the upheaval, developed economies do not cede yet another sector of the global industrial economy to China, or large swathes of mining rights such as central Africa.

“THERE IS PROBABLY GREATER WILLINGNESS IN THE WEST NOT TO CEDE YET ANOTHER SECTOR OF THE GLOBAL INDUSTRIAL ECONOMY TO CHINA, OR LARGE SWATHES OF MINING RIGHTS SUCH AS CENTRAL AFRICA”

But can we afford it?

Even those who admire the ideals of the climate change kids criticise their new deals and wish lists as unaffordable.

It is not surprising that a report on mining that opens with a quote from Thomas Hobbes would possess a deep moral core and towards the end Gait tackles the issue:

It is, however, important to remember that when we highlight the impact of decarbonisation on copper prices there is absolutely no sense in which this can be taken to imply that we ‘cannot afford’ to deliver a “green economy” (and the resulting transformation of industrial and economic processes).

The market capitalisation of such entities as Facebook or Netflix imply that there is more than enough money, more than enough capital to deliver whatever economic transformation is required. The fact that our revealed preference (amusing cat videos) is at variance with our stated preference (a sustainable economic future for our children) should not be erroneously taken to infer that there is some financial constraint on the ends we choose to pursue.

Source: Mining dot Com